Hoovering up Talent From Abroad!

Posted on: 08 Apr, 19

Oury explains to Clark a number of tax incentives for individuals to come and work in the UK on a short-term secondment, including the delights of Detached Duty Relief!

Slough Office: Herschel House,

58 Herschel Street, Slough SL1 1PG

London Office: 10 John Street,

London WC1N 2EB

Slough Office: Herschel House,

58 Herschel Street, Slough SL1 1PG

London Office: 10 John Street,

London WC1N 2EB

Posted on: 08 Apr, 19

Oury explains to Clark a number of tax incentives for individuals to come and work in the UK on a short-term secondment, including the delights of Detached Duty Relief!

Clark… have you seen the news that Dyson has announced it is moving its headquarters from the UK to Singapore?

I did! Cheeky monkey, a staunch supporter of Brexit and he has flown the coup anyway! Did you know he was the biggest farmer in the UK as well?

No I didn’t. Well there is an industry struggling with labour shortages. Where it will find the workers to pick fruit and vegetables this summer is a serious question.

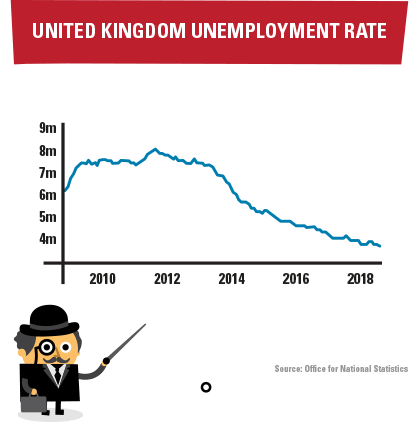

Yes I think his “farming” is less, well, “traditional” in nature. But access to labour is such a key issue. The UK unemployment rate is at 3.9 percent as at January 2019, its lowest level since January 1975.

Things are going to get worse until, I guess, they get much better as the robots take over and we are all out of a job!

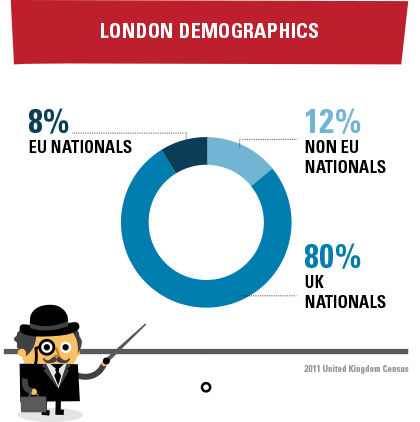

Ha! Yes indeed Clark. You and me included! Anyway, for now companies are going to need to understand how to bring in workers. Thankfully for more skilled labour required in the entrepreneurial sector there are, and always have been, many options for those from outside of Europe in terms of visas and indeed tax reliefs to support their relocation into the UK. Indeed so much of the talent in the UK is not from Europe but from further a field.

Well I guess we should start ‘hoovering’ up more of the talent from abroad to compensate?

Good one, Clark, if not a bit cheesy (even for your standards)!

With all the talk surrounding the uncertainty of Brexit and companies relocating overseas, the good news is that there is plenty of talent that remains really happy to come to work in the UK and there are specific visas and tax reliefs designed to support individuals coming to work or expand their business in the UK.

Indeed! It breaks my heart to think that some UK companies are not aware of the wonders of ‘Detached Duty Relief (DTR)’!

It breaks your heart? Oury I really think we need to chat about your love life but anyway, “it breaks my heart” that I am not aware of the wonders of ‘DTR’. Can you please elaborate?

Well, if an employee of an overseas company attends a temporary workplace in the UK for a period of up to 24 months they may be able to obtain relief for the cost of travel to and from that workplace, accommodation and subsistence attributable to attendance at that workplace.

That sounds far too good to be true… what’s the catch?

No catch! Naturally some conditions apply such as:

Amazing! But how would the employee go about obtaining this relief? A long arduous admin process I am assuming?

Ever the optimist aren’t you! If the individual pays for the expenses out of his own pocket then the expenses incurred are offset against the individual’s income, therefore reducing their taxable income!

Alternatively, if the employer reimburses the individual for expenses they have incurred, the amounts reimbursed are declared on the employee’s form P11D for the relevant tax year. On the form P11D, detached duty relief is applied resulting in a nil taxable benefit arising. Not so bad see?

Okay, but what about the company? What benefits do they get?

Apart from having a highly talented and skilled individual in the workforce, when the employer reimburses the individual for the costs incurred, the payment is deductible for corporation tax purposes.

In addition, reimbursing employees for expenses such as rent would usually constitute a taxable benefit and incur a Class 1A national insurance contribution (NIC) charge at 13.8%. Provided the expenses qualify for detached duty relief, the reimbursement will not result in a NIC liability! In essence this means that the accommodation and living costs can be paid tax free, and the company doesn’t have to pay employers national insurance on top of this amount – a significant tax saving for the employer.

Ok, I’m still a bit lost, can you give me an example?

Sure. Let’s imagine that the total annual budgeted salary cost for an employee is £100,000 and their costs are as follows:

Over 12 months, the total costs for living and accommodation will be £42,000 (£3500 x 12).

DTR means that £42,000 can be paid tax free and £58,000 paid as a taxable salary.

For a £100,000 salary, an employer would normally pay £12,609 in NICs.

Applying DTR, as in the example above, the employer would pay £6,813 in NICs.

That’s a saving of almost £6,000 for the employer!

(Do note that DTR needs to be applied and administered in the correct way by working through the facts of the arrangement and notifying HMRC appropriately, you can’t just start handing them a tax free amount!)

Okay! I am sold! Are there any other tax planning opportunities you care to mention?

Yes, there could also be a complete exemption from National Insurance for the employee and the employer for the first year or more depending on which country they come from.

No way?

Yes way! Again this depends which country you are coming from.

For workers who intend to remain in the UK for up to 3 years and who have business trips outside of the UK there may be a tax exemption available on the proportion of their employment income relating to days spent working abroad. This is otherwise referred to as Overseas Workday Relief (OWR).

As with DTR, there are some complex rules surrounding OWR but provided the rules are applied correctly and advice is sought early, overseas workers can benefit from significant tax planning opportunities.

Excellent. And considering the variety of visas available to individuals looking to work in the UK, it is relatively straight forward to get the individuals over here, set up and ready to work.

Talking about visas and given that I have shared my knowledge with you, are there any particular visas recommended for people looking to come and work in the UK?

The ‘representative of an overseas business’ visa springs to mind. This allows an overseas company to send a single employee to work full-time in the UK in order to set up a branch or subsidiary of their company. The visa is granted for an initial 3-year period and can be extended for a further 2 years.s.

Sounds ideal. As with detached duty relief, I imagine there must be some qualifying criteria?

Unsurprisingly conditions do apply. The main ones are:

What about if you are an overseas company with a UK subsidiary or branch operating already? Are there any visa options that will still allow for DTR?

Where there is common ownership and control of both the overseas company and UK entity, the UK entity can apply for a Tier 2 Sponsor Licence that specifically facilitates intra-company transfers of employees between the two entities.

Common ownership and control meaning that the UK entity is a wholly owned subsidiary of the overseas company or that both entities have the same majority shareholder/s?

Exactly and this opens up the option of the Tier 2 (Intra-Company Transfer (ICT)) visa for employees who can be transferred to the UK entity for a period of up to 5 years in total, so long as the individual:

And where does DTR come into all this?

So long as the conditions that you spoke about earlier are met then DTR can be claimed on relevant expenses.

It is always useful to have a secondment agreement in place for the applicant, with terms that are consistent with the criteria for claiming for DTR. In particular, the secondment is for a maximum period of 24 months and the individual’s employment with the overseas entity will continue, although if the individual is from the USA, the initial intention should be that the secondment will only last 12 months

Maybe Mr. Dyson should think about creating the “Oury and Clark” model vacuum, he could be hoovering up all the best talent with us in the bag!

We are but two fictitious characters throwing out ideas and comment to stimulate debate and collect information. As professional service firms, we are open-minded people and think independent thought and debate are essential to help us understand as well as navigate complex problems. By joves – doing business across Europe (and the world) is set to become a whole lot more complex in light of recent seismic political events. As businesses – we provide information and hopefully some wisdom – and we see this blog and its caricatures merely as a much more fun, perhaps slightly controversial, way of stimulating debate and collecting ideas. We’re searching for some true pearls of wisdom, and as we find them, we’ll share them with you.

To find your nearest office or get in touch with one of our specialist advisors to see how we can help your business, please go to our contact page.