|

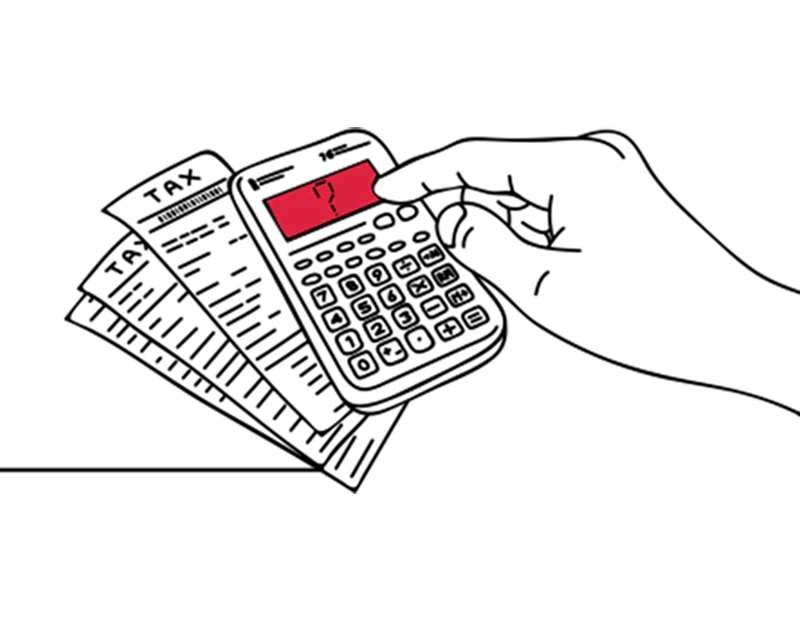

Country

AUSTRIA

|

Standard Rate

20%

|

Reduced Rate 1

13%

|

Reduced Rate 2

10%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

BELGIUM

|

Standard Rate

21%

|

Reduced Rate 1

12%

|

Reduced Rate 2

6%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No - Subject to confirmation

|

|

Country

BULGARIA

|

Standard Rate

20%

|

Reduced Rate 1

9%

|

Reduced Rate 2

-

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

CROATIA

|

Standard Rate

25%

|

Reduced Rate 1

13%

|

Reduced Rate 2

5%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

CYPRUS

|

Standard Rate

19%

|

Reduced Rate 1

9%

|

Reduced Rate 2

5%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

CZECH REPUBLIC

|

Standard Rate

21%

|

Reduced Rate 1

12%

|

Reduced Rate 2

12%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

DENMARK

|

Standard Rate

25%

|

Reduced Rate 1

-

|

Reduced Rate 2

-

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

ESTONIA

|

Standard Rate

20%

|

Reduced Rate 1

9%

|

Reduced Rate 2

5%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

FINLAND

|

Standard Rate

25.5% from 1st September 2024

|

Reduced Rate 1

14%

|

Reduced Rate 2

10%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

FRANCE

|

Standard Rate

20%

|

Reduced Rate 1

10%

|

Reduced Rate 2

5.5%

|

Reduced Rate 3

2.1%

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

GERMANY

|

Standard Rate

19%

|

Reduced Rate 1

7%

|

Reduced Rate 2

-

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

GREECE

|

Standard Rate

24%

|

Reduced Rate 1

13%

|

Reduced Rate 2

6%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

HUNGARY

|

Standard Rate

27%

|

Reduced Rate 1

18%

|

Reduced Rate 2

5%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

IRELAND

|

Standard Rate

23%

|

Reduced Rate 1

13.5%

|

Reduced Rate 2

9%

|

Reduced Rate 3

4.8%

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

ITALY

|

Standard Rate

22%

|

Reduced Rate 1

10%

|

Reduced Rate 2

5%

|

Reduced Rate 3

4%

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

LATVIA

|

Standard Rate

21%

|

Reduced Rate 1

12%

|

Reduced Rate 2

5%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

LITHUANIA

|

Standard Rate

21%

|

Reduced Rate 1

9%

|

Reduced Rate 2

5%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

LUXEMBOURG

|

Standard Rate

17%

|

Reduced Rate 1

13%

|

Reduced Rate 2

7%

|

Reduced Rate 3

3%

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

MALTA

|

Standard Rate

18%

|

Reduced Rate 1

7%

|

Reduced Rate 2

5%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

NETHERLANDS

|

Standard Rate

21%

|

Reduced Rate 1

9%

|

Reduced Rate 2

-

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

POLAND

|

Standard Rate

23%

|

Reduced Rate 1

8%

|

Reduced Rate 2

5%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

PORTUGAL

|

Standard Rate

23%

|

Reduced Rate 1

13%

|

Reduced Rate 2

6%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

ROMANIA

|

Standard Rate

19%

|

Reduced Rate 1

9%

|

Reduced Rate 2

5%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

SLOVAKIA

|

Standard Rate

20%

|

Reduced Rate 1

10%

|

Reduced Rate 2

-

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

No

|

|

Country

SLOVENIA

|

Standard Rate

22%

|

Reduced Rate 1

9.5%

|

Reduced Rate 2

5%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

SPAIN

|

Standard Rate

21%

|

Reduced Rate 1

10%

|

Reduced Rate 2

4%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

SWEDEN

|

Standard Rate

25%

|

Reduced Rate 1

12%

|

Reduced Rate 2

6%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

Yes

|

|

Country

ICELAND

|

Standard Rate

24%

|

Reduced Rate 1

11%

|

Reduced Rate 2

-

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

-

|

|

Country

NORWAY

|

Standard Rate

25%

|

Reduced Rate 1

15%

|

Reduced Rate 2

11.1%

|

Reduced Rate 3

6%

|

Fiscal Rep Needed For UK Companies?

-

|

|

Country

SWITZERLAND

|

Standard Rate

8.1%

|

Reduced Rate 1

3.8%

|

Reduced Rate 2

2.6%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

-

|

|

Country

TURKEY

|

Standard Rate

18%

|

Reduced Rate 1

8%

|

Reduced Rate 2

1%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

-

|

|

Country

UNITED KINGDOM

|

Standard Rate

20%

|

Reduced Rate 1

5%

|

Reduced Rate 2

0%

|

Reduced Rate 3

-

|

Fiscal Rep Needed For UK Companies?

-

|